There are a million things to trade every day, and there are a million ways to trade them. When you’re getting your sea legs as a trader, it can be hard to see what others are able to do so easily while you can’t seem to make a single winning trade. I know some traders that move around the market trading 50+ names, jumping from ticker to ticker without pause.

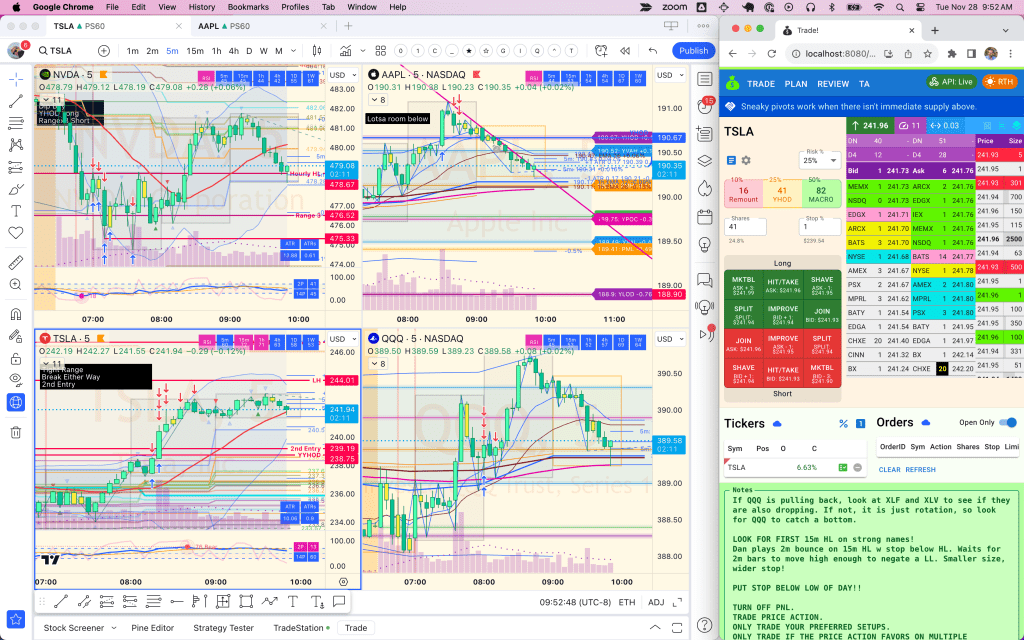

At this point in my trading career, I am unable to trade more than a handful of names at the same time. Right now I focus on the beta stocks and their ETF (AAPL, AMD, AMZN, GOOGL, META, MSFT, NFLX, NVDA, TSLA, and QQQ). Within those names, I primarily trade just TSLA and NVDA. I do this because I’ve recognized that I have a fixed memory stack in my brain. If all you did was trade one or two names (as many futures traders do), you’d still have hundreds or thousands of data points to process in real time in order to execute well. Not to mention that your screen real-estate is finite!

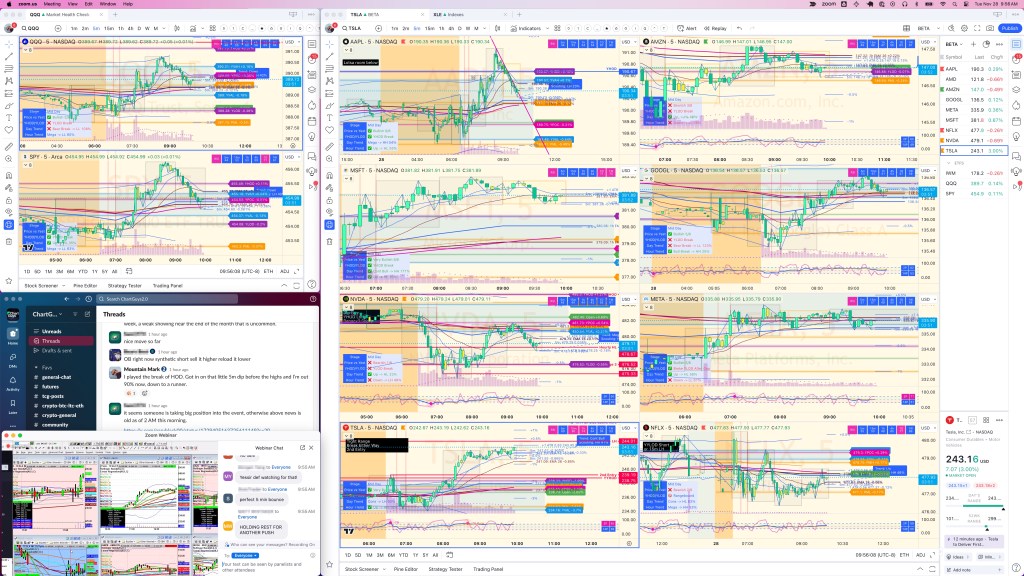

I have two screens: one where I actively trade that shows me the TradingView charts I’m watching most closely, which are typically: QQQ, NVDA, TSLA plus one other stock-du-jour, plus my trading app. My second screen is a big one where I have a TradingView window for the market ETFs (SPY, QQQ), and another where I show all of the BETAS, with a second tab for the various sector ETFs. Finally, in one corner I have the various communities I trade with: Chart Guys and Access a Trader, and I alternate between the two chat rooms (bottom left corner of my big screen, below).

For me, that 👆 is a lot of information to process. I’ve found that if I take on more data than that, my brain starts to misfire: I miss things that I would have caught otherwise; I miss candle patterns that signal a change; I miss patterns confirming my trade ideas; and I get distracted by the new shiny focus of the market, and I generally lose my grasp of what is happening in the overall market. It can be difficult to reset and regain my composure, and I often need to stop trading once it happens.

Communities can be very distracting for new traders. When people post about something they’re excited about that wasn’t on your radar, it causes you to stop what you were doing to take a look, and the next thing you know you’re trading something you shouldn’t be (and losing) or missing a trade you had prepared for prior to the new distraction.

For the beginning trader, I’ve found that in order to execute winning trades, you need to stick to your plan and your own trade ideas. I’m still involved in the communities I trade with, but I don’t allow myself to get pulled in multiple directions. I post and respond to posts related to what I was already trading. Very rarely do I ever jump to something else. This can be insanely frustrating when you see that names others were focused on that are outside your trade plan are running without you. The party parrots start to pop up all over the place as the other traders are excitedly chattering about their successes. I can’t even count the number of days when entire communities of other traders were absolutely crushing it while I was red on the day.

But here’s the thing: I’m still here. I’ve seen the turnover in all trading communities over the last couple of years, and it’s been crazy. All those traders who were screaming about their profits are gone now, and here I am still quietly chugging along, more confident every day, slowly increasing my budget as my PNL curve slowly moves up.

I’m not in this for the win of the day, If I have my way, I’m in this for the rest of my life. I believe that is the key to success as a trader: focus, skip the distractions, focus, watch only what you’re able to process, focus, be patient, and focus, focus, focus.